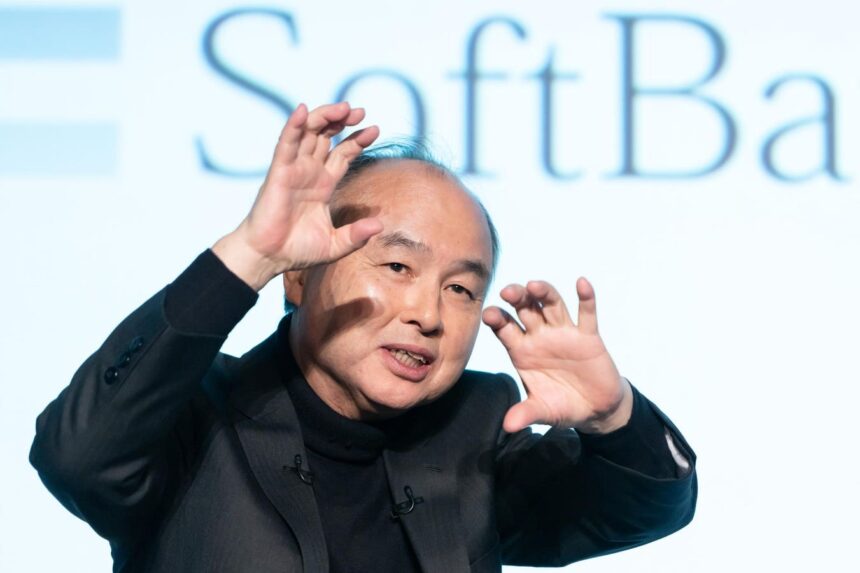

SoftBank chief executive officer Masayoshi’s boy talked at a February conference with Open AI Chief Executive Officer Sam Altman on the occasion to transform service via AI via AI.

tomohiro ohsumi/getty photo

SoftBank Team owner Masayoshi’s boy took the royal household back to Japan’s richest male after 4 years of void, with his Tokyo-listed financial investment team supply moring than 60% this year because of positive outlook concerning capitalists’ leads for AI.

According to Forbes, the 68-year-old large male is SoftBank chairman and chief executive officer, with a total assets of $50.5 billion, generally based upon business shares. According to the real-time billionaire checklist, he currently exceeds his previous top lot of money of $45.4 billion. He is currently richer than Uniqlo’s quick retail owner Tadashi Yanai, that has a ton of money of $46.8 billion.

The boy yielded the crown to Yanai in 2022 as Softbank’s share cost dropped after its substantial Vision Fund Finances Financial Investment Nitts. Currently, financial investments in AI-related business (particularly Chatgpt Developer Openai) are taken into consideration to place the business’s development.

” SoftBank supplies public capitalists with a means to connect with AI subjects,” Dan Baker, elderly equity expert at Melbourne study company Morningstar claimed by means of e-mail.

Capitalists are piling SoftBank due to the fact that OpenAI is independently held, stopping them from acquiring a firm that signifies the AI boom. SoftBank and OpenAI have actually developed calculated collaborations, such as the $500 billion Stargate AI framework job and financial investment contract. Softbank is a capitalist with $40 billion lately introduced by Openai, concentrating on the $300 billion designers of Chatgpt. It intends to spend as high as $30 billion in the united state business, with the staying $10 billion in a collection of concealed co-investors.

As his boy seeks the objective of fabricated superintelligence (ASI), or AI, SoftBank makes various other AI-related wagers, which he calls “knowledge a thousand times greater than human knowledge.” SoftBank lately recommended risk in NVIDIA and gotten thousands of countless bucks in shares in Oracle and Taiwan Semiconductor Production Firm (TSMC).

On The Other Hand, concerning 90% of Nasdaq-listed chip style business Arm Holdings, had by SoftBank, introduced strategies this year to make its very own semiconductors, a significant modification in its service design that offers software application just. It tries to make use of the raising need for semiconductors that can refine information from numerous AI solutions quicker.

SoftBank likewise wishes to invest $6.5 billion to acquire American chip style business Ampere Computer, which introduced recently that web income was 421.82 billion yen ($ 2.9 billion) in the 3 months finishing in June, while shedding 174.3 billion yen a year back, shedding 174.3 billion yen a year back, and shedding 12.7 billion yen a year back and 12.7 billion yen (by means of $12.7 billion yen. Its income expanded 7% year-on-year to 1.8 trillion yen.

Yet over the previous couple of years, SoftBank has actually traded at a dramatically affordable cost on its total assets. Capitalists are worried concerning the monetary utilize of a firm and what is typically viewed as a favorable financial investment method.

The discount rate has actually avoided 50% previously this year to around 40% as individuals start to understand SoftBank’s directions are “proper”. He confessed on the phone call that Stargate was slower than anticipated due to the fact that it took a while to choose a website and elevate funds for the information facility.

Morningstar’s Baker claimed that if SoftBank remains to sink funds right into Celebrity Gateway, financial obligation threats can enhance. SoftBank presently has a loan-to-value proportion of 17%, which is listed below the business’s self-imposed ceiling of 25%. This statistics actions SoftBank’s financial obligation to gauge the worth of equity holdings in its monetary setting.

SoftBank might market properties to money its financial investments in OpenAI and Stargate, a Hong Kong expert at Deutsche Financial institution, composed in a study note on Monday. The business has actually marketed $4.8 billion in T-Mobile supply in June to money its AI financial investment.

SoftBank might market much more T-Mobile supplies or supplies for financial investment functions, Baker claimed. Yet he likewise urges that Japanese empires might wish to keep control of ARM or ensure their shares as security for funding.