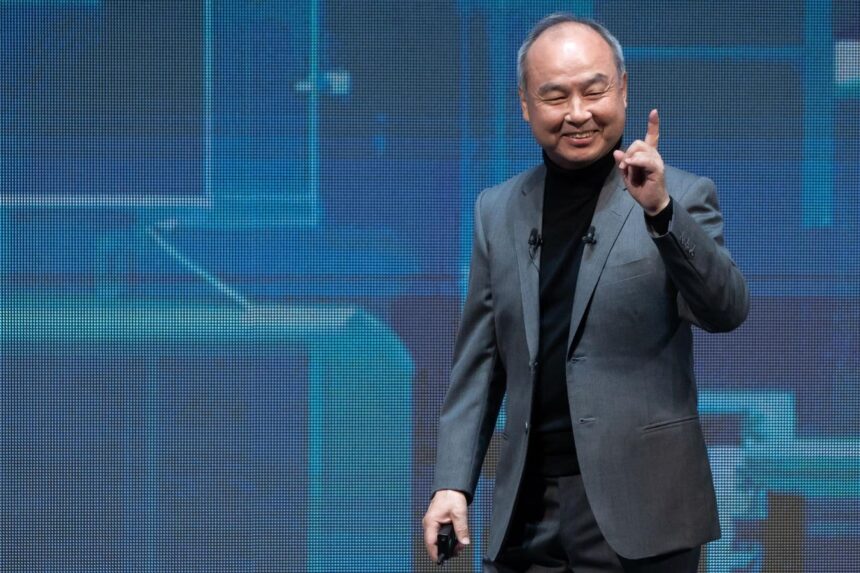

SoftBank Team chief executive officer Masayoshi’s child talked at SoftBank Globe in Tokyo in October 2023.

Professional photographer: tomohiro ohsumi/getty Pictures

SoftBank accepts obtain $2 billion in shares as Japanese corporations remain to strengthen their financial investment in the united state, according to a joint declaration from both firms launched on Tuesday.

The bargain receives the popular end and will certainly enable SoftBank to obtain Intel ordinary shares for $23 each, the declaration stated. That rate is somewhat less than the chipmaker’s closing rate of $23.70 on Monday. Supplies skyrocketed 5.3% in after-hours trading after the news.

” Masa [SoftBank founder Masayoshi Son] I have actually functioned very closely for years and I thank him for his self-confidence in this financial investment. Intel chief executive officer Lip-bu Tan stated in a declaration.

Simply 2 weeks earlier, united state Head of state Donald Trump asked Tan to surrender promptly since he was worried concerning his earlier partnership with China. The Trump management was later on extensively reported to have talks with Intel as the White Home bargained for the united state federal government to obtain shares in the firm.

SoftBank is seeking financial investment chances connected to semiconductors and expert system as his child is progressively concentrating on AI.

It has actually bought Chatgpt Designer Openai and is collaborating with the last to perform a $500 billion Stargate AI facilities task in the USA, coming to be a financier beloved. This year, its noted supplies have actually been noted almost 80%, making their child the void in Japan 4 years later on.

The 68-year-old mogul has a total assets of $56 billion, primarily based upon SoftBank shares, which is viewed as a winning financial investment method. Capitalists go back to “assume Mr. Child is a financial investment brilliant,” Deutsche Financial institution expert Peter Milliken created in a study note released last Friday.

Capitalists have actually long taken pleasure in discount rates on SoftBank supplies as a result of problems concerning the hostile and high-risk financial investment design taken into consideration to be their child. Milliken thinks the price cut is no more sensible, with his rate target of 20,000 yen ($ 135.3) per SoftBank, suggesting a 21.5% rise from Tuesday’s rate.