Chinese abundant ridiculous realty fanatic poster youngster China Ever before Evergrande will certainly break down and shed. Nonetheless, its $30 billion fell down wreck can take a years to snuff out.

Evergrande Team one-on-one Stick Out from the Hong Kong Stock Market On Monday, Communist leaders might enjoy to see it provided its dark darkness on a shut and greatly unbalanced system.

Evergrande was as soon as the primary programmer in the nation. Its IPO in Hong Kong in 2009 was the biggest IPO for a personal programmer in China, however wound up with the biggest financial obligation of the worldwide realty market.

See additionally: Chinese court states business have to pay employees’ pension plans; anxiety of job dilemma

The building proceeds till the business mores than till its thriving tale finishes– in recent times, its suggestions will certainly be the biggest by market price and amount.

For the business’s financiers, the trip is not just grand.

Limitless financial obligation development

Designers began their launching with a solid public market, with supplies worth $9 billion at the end of 2009, expanding fivefold to $51 billion 8 years later on, till just recently in the world. Currently worth $282 million.

The business’s trip from the beloved of the stock market to the untouchables in the economic market is a caution tale concerning endless financial obligation development worldwide’s second biggest economic climate.

Its supply was gotten at $31.39 per share at its optimal, when it was the last exchange 19 months back, its share cost was up to HK$ 0.163.

The supply’s show to greater than $300 billion in the red have actually been put on hold for greater than $300 billion in the red because the liquidation order on January 29, 2024 went against the financial obligation and fell short to settle the restructuring strategy.

According to an August 12 declaring, Evergrande attracted attention from the Hong Stock Market since it fell short to return to trading within 18 months.

5 years of building dilemma

This fussy finishes a phase in China’s extraordinary building dilemma that started in 2021, although it’s not likely to be the last eventful individual as the market remains to be pestered by liquidity compression and absence of need.

Previously this month South China City After the destiny of taking a trip with a couple of personal peers, he came to be the very first building programmer to acquire a liquidation order from the Hong Kong High Court.

” Evergrande is among the spots instances of the collapse of China’s realty market,” stated Gary Ng, elderly economic expert at financial investment financial institution Natixis.

While postponing it is “greatly symbolic”, he stated “still note completion of the golden era of China’s realty market”.

Over the previous couple of years, Chinese authorities have actually been functioning to bring back the realty market that as soon as represented a quarter of its GDP, while customers wait on incomplete homes to be turned over to them, and financial institutions intend to recuperate their cash.

” When individuals have a vacant pocket, it’s tough to recuperate customer need and feeling,” stated Oscar Choi, primary financial investment policeman at Hong Kong’s Oscar and companion Funding Ltd, that functioned as an equity expert at a financial investment financial institution for several years as a financial investment financial institution.

Evergrande decreased to comment.

Developers shuffle to remain drifting

Evergrande’s suggestion is that lots of various other programmers rush to remain drifting and prevent liquidation by guaranteeing financial institutions sustain for renovating financial obligations.

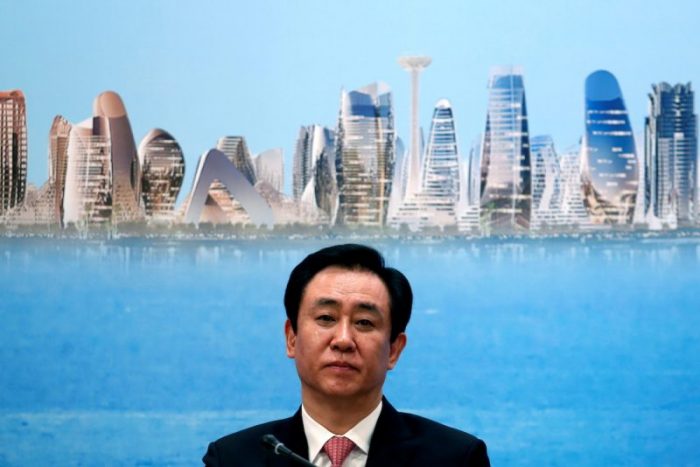

Evergrande promptly climbed to the leading and after that a substantial collapse showed the destiny of its owner, elevated by his grandma in a country town in Henan District, and at first a steel service technician and turned into one of the wealthiest individuals in China.

At the 2009 Evergrande launch celebration, it was loaded with sparkling wine. hui ka yan Numerous Hong Kong magnates, consisting of the late owner of Hong Kong realty large New Globe Advancement, and Joseph Lau, owner of China Chateau, additionally signed up with.

Last March, HUI was prohibited from the long-lasting safeties market and fined RMB 47 million after regulatory authorities implicated the team of front runner shops of swelling outcomes, safeties scams and failing to divulge in a prompt fashion.

Hui has actually never ever shown up in public because her apprehension in 2023, however the business liquidator is battling the court to freeze his and his previous partner’s abroad possessions and recuperate $6 billion paid in returns and pay him and various other previous execs.

Lawyers anticipate the liquidation procedure to take 10 years and the financial institution healing price might be really reduced.

Evergrande liquidators stated they recouped concerning $255 million recently by liquidating the business’s overseas possessions, consisting of college bonds, club subscription, art work and automobile.

Comparative, the overall quantity of insurance claims made by financial institutions versus liquidators is $45 billion.

Some home customers and financiers wanting to buy Evergrande’s riches monitoring items are additionally decreasing.

” After viewing a great deal of building, I picked Evergrande since I do not assume such a large programmer will certainly collapse. I was incorrect.” Douyin customer 8AD2D1D4 is waiting to approve his home acquisition and created in a social media sites blog post.

He might be just one of thousands.

- Jim Pollard’s Additional Input and Modifying by Reuters